SC-COH: Manage My Profile - Maintain Addresses

This screen displays a table with the address information currently on file with the Texas Ethics Commission (TEC) for your filer account. If you have filed a campaign treasurer appointment (Form CTA) with the TEC, the treasurer's address information currently on file is also displayed. The TEC will use this address information to send you correspondence that cannot be sent by email. Please note: It is important for you to keep this information up-to-date so that you do not miss any notices regarding your filing requirements.

Any changes you make to your filer or treasurer address(es) in the filing application will also update your information on file with the TEC. You may provide up to three addresses (Mailing, Street and Other) for both the filer and the treasurer. To add a new address, click the

Addresses on SC-COH Reports: The addresses marked with an asterisk (*) in the address table on this screen will be entered on the reports you file using this filing application. The address you enter as the Filer Mailing Address will be used for the "Candidate Address" on the Cover Sheet of your reports. If you have a campaign treasurer appointment on file, the address you enter as the Treasurer Street Address will be used for the "Campaign Treasurer Address" on the Cover Sheet of your reports.

SC-COH: Manage My Report - Address Entry

Please note: It is important for you to keep this information up-to-date so that you do not miss any notices regarding your filing requirements.

Any changes you make to your filer or treasurer address(es) in the filing application will also update your information on file with the TEC. You may provide up to three addresses (Mailing, Street and Other) for both the filer and the treasurer or chair, as applicable.

Editing an Address:

Filer/Treasurer/Chair (Display Only): This information may not be edited. The person (Filer or Treasurer) whose address you are editing is displayed, based on your selection on the "Maintain Addresses" screen.

Address Type (Display Only): This information may not be edited. The general type (Mailing, Street, or Other) of the address you are editing is displayed, based on your selection on the "Maintain Addresses" screen.

Address (Street Address 1, Street Address 2, City, Country, State, Zip Code): Enter the complete address for the displayed person and address type. If you are entering a Mailing address, use the Street Address 1 field to enter a P.O. Box.

Adding an Address:

Filer/Treasurer/Chair: Only valid choices are shown in the drop down list. If you do not have an active campaign treasurer appointment (Form CTA) on file, then you will not see Treasurer as a valid choice. Select the type of person for which the address you are adding applies:

Address Type: Only valid choices (address types not currently on file) are shown in the drop down list as available to add. You must have at least one address for the filer. If you have an active campaign treasurer appointment on file, you must also have at least one address for the treasurer. You may also provide additional addresses as back-up contact information. You may provide a maximum of three addresses for each person.

Address (Street Address 1, Street Address 2, City, Country, State, Zip Code): Enter the complete address for the selected person and address type. If you are entering a mailing address, use the Street Address 1 field to enter a P.O. Box.

SC-COH: Manage My Report

Click on the

Other Report Options:

In-Progress Reports shows you the following information about the report(s) you have started in the TEC filing application but have not yet filed:

You may also click on the Print button to print a copy of an in-progress report in PDF format or click on the Delete button to delete an in-progress report.

You may also click on the Upload File button if you entered your contribution or expenditure data in a separate spreadsheet and need to upload the file into an in-progress report in the TEC filing application. For more information, see the Import/Export Guide.

Missing/Late Reports shows you the following information about the report(s) that, according to TEC records, you were required to file with the TEC by a certain deadline but have not yet filed. Note: You may be subject to a late-filing penalty (late fine) for a required report that is not filed by the filing deadline.

Filed Reports shows you the following information about the report(s) you have successfully filed with the TEC:

If you discover an error or omission in a filed report, you may click on the Correct/Update button to start a Corrected Report. Once you start a Corrected Report, that action button will be removed but the original report will continue to display in your

If you filed a report after the filing deadline, you may be subject to a late fine. If you need to pay a late fine for a filed report, you may click on the Pay Fine button next to the applicable report to access the electronic payment screen.

SC-COH: Cover Sheet – Report Type & Period Covered

What kind of report do you want to file? (Report Type): You can only select one of these report types for this report. If you need to file more than one of these report types, you must file each as a separate report. You can select one of the following report types as a stand-alone report or in combination with the "Final" report below, if applicable. Read the information concerning each of the report types. Select the radio button for the report type that applies to the event for which you are filing.

State Party Chair Candidates: If you are a candidate for state chair of a political party, you are required to file the following reports:

January 15th Semiannual Report: All candidates for State Party Chair must file a semiannual report with the TEC by midnight Central Time on the January 15 report due date. Note: Anyone who has a campaign treasurer appointment (Form CTA) on file must file semiannual reports, even after an election has ended and even if the filer lost the election. To end this semiannual filing requirement, the filer must cease campaign activity and file a Final report. (See Final Report below for more information.)

July 15th Semiannual Report: All candidates for State Party Chair must file a semiannual report with the TEC by midnight Central Time on the July 15 report due date. Note: Anyone who has a campaign treasurer appointment (Form CTA) on file must file semiannual reports, even after an election has ended and even if the filer lost the election. To end this semiannual filing requirement, the filer must cease campaign activity and file a Final report. (See Final Report below for more information.)

30th Day Before State Convention Report: All candidates for State Party Chair must file this report with the TEC by midnight Central Time no later than 30 days before the state political party convention convenes.

8th Day Before State Convention Report: All candidates for State Party Chair must file this report with the TEC by midnight Central Time no later than 8 days before the state political party convention convenes.

Final Report: A candidates for State Party Chair may file this report when no further campaign activity is anticipated. See Final Report below for more information.

County Party Chair Candidates: If you are a candidate for political party chair of a county that meets certain population requirements, you are required to file the following reports:

January 15th Semiannual Report: Candidates for County Party Chair must file a semiannual report with the TEC by midnight Central Time on the January 15 report due date. Note: Anyone who has a campaign treasurer appointment (Form CTA) on file must file semiannual reports, even after an election has ended and even if the filer lost the election. To end this semiannual filing requirement, the filer must cease campaign activity and file a Final report. (See Final Report below for more information.)

July 15th Semiannual Report: Candidates for County Party Chair must file a semiannual report with the TEC by midnight Central Time on the July 15 report due date. Note: Anyone who has a campaign treasurer appointment (Form CTA) on file must file semiannual reports, even after an election has ended and even if the filer lost the election. To end this semiannual filing requirement, the filer must cease campaign activity and file a Final report. (See Final Report below for more information.)

30th Day Before Primary Election Report: Opposed candidates for County Party Chair in a primary election who did not choose the modified reporting schedule must file this pre-election report. If an opposed candidate chose modified reporting, but then exceeded a threshold before the 30th day before the election, the candidate must file this report. (Note: Candidates for County Party Chair who are unopposed in a primary election are not required to file pre-election reports for that election.) The report is due no later than 30 days before the primary election and must be filed with the TEC no later than midnight Central Time on the report due date.

8th Day Before Primary Election Report: Opposed candidates for County Party Chair in a primary election who did not choose the modified reporting schedule must file this pre-election report. If an opposed candidate chose modified reporting, but then exceeded a threshold before the 8th day before the election, the candidate must file this report. (Note: Candidates for County Party Chair who are unopposed in a primary election are not required to file pre-election reports for that election.) The report is due no later than 8 days before the primary election and must be filed with the TEC no later than midnight Central Time on the report due date.

Runoff Report: Candidates for County Party Chair who are participating in a runoff election must file this runoff report. The report is due no later than 8 days before the runoff election and must be filed with the TEC no later than midnight Central Time on the report due date.

Final Report: A Candidates for County Party Chair may file this report when no further campaign activity is anticipated. See Final Report below for more information.

Less Commonly Filed Report (State and County Party Chair Candidates): This report is only required if you meet certain criteria. You can select this report type as a stand-alone report or in combination with one of the reports listed above, if applicable. Select the radio button for this less commonly filed report only if the report type applies to the event for which you are filing.

Final Report: You may file a Final report if you have a campaign treasurer appointment (Form CTA) on file with the TEC and meet all of the following: 1) do not expect to accept any more campaign contributions or make or authorize any more campaign expenditures, 2) expect to take no further action to get elected to a public office, and 3) do not intend to continue accepting contributions to pay campaign debts. There is not a fixed deadline for this report.

• You must have a CTA on file to accept contributions to offset campaign debts or to pay campaign debts. If you intend to continue this campaign activity, do not file a final report at this time.

• A final report will terminate your CTA and relieve you from any additional filing obligations as a candidate. If you have surplus political funds or assets, you will be required to file annual Unexpended Contribution reports. (See Unexpended Contributions under "Other Reports" for more information.)

• Terminating a CTA does not relieve you of your responsibility for any delinquent reports or outstanding civil penalties.

• An elected State Party Chair who does not have a CTA on file is still required to file a personal financial statement (PFS) in accordance with chapter 572 of the Government Code. You can set up a PFS filer type with TEC to file PFS using this filing application, if applicable.

Other Reports (State and County Party Chair Candidates): This report type is only required in certain circumstances and cannot be combined with other report types. Select the radio button this other report only if the report type applies to the event for which you are filing.

Unexpended Contributions Report-Annual (For Former Candidates for State or County Party Chair): You must file this report if you filed a final report as a candidate for State Party Chair or County Party Chair and you had unexpended political contributions, interest, assets, or other money earned from political contributions at the time you filed the final report.

If you are a former candidate for State or County Party Chair with unexpended funds or assets, you must file an annual Unexpended Contributions report by midnight Central Time on January 15 following each year in which you maintained unexpended contributions or assets. You must continue to file annual Unexpended Contribution reports until you have disposed of all your unexpended contributions or assets. (See "Unexpended Contributions Report-Final" below for more information about the report of final disposition.) Proper Ways to Dispose of Unexpended Funds and Assets

Unexpended Contributions Report-Final (For Former Candidates for State or County Party Chair): You must file Unexpended Contribution reports if you filed a final report as a candidate for State Party Chair or County Party Chair and you had unexpended political contributions, interest, assets, or other money earned from political contributions at the time you filed the final report. (See "Unexpended Contributions Report-Annual" above for more information about the annual reports.)

Once you have disposed of all your political contributions or assets, you will file an "Unexpended Contributions-Final" report. You may not retain unexpended contributions or assets longer than 6 years after the date you filed your final report. The latest possible date for filing a "final disposition" report of unexpended contributions is 30 days after the end of that six-year period. Proper Ways to Dispose of Unexpended Funds and Assets

Period Covered: The filing application will calculate the period covered for your report based on the report type you select. You can modify the start and end dates as long as your modified start date does not precede the filing application calculated start date and your modified end date does not extend past the filing application calculated end date. If you need to report activity outside of the filing application-calculated date range for this report, you will need to file multiple reports.

A reporting period includes the Start date and the End date. The report due date will be after the end of the period. Generally, a report picks up where the last report left off and there should be no gaps or overlapping periods.

First Reports. If this is the first campaign finance report that you have filed, the start date will be the date your campaign treasurer appointment (Form CTA) was filed.

State and County Party Chair Candidates:

January 15th Semiannual Report Period: The start date is July 1 of the previous year or the day after the last day covered by your last required report, whichever is later. If this is the first report you have filed, please see the First Reports section above. The end date is December 31 of the previous year.

July 15th Semiannual Report Period: The start date is January 1 or the day after the last day covered by your last required report, whichever is later. If this is the first report you have filed, please see the First Reports section above. The ending date is June 30.

Final Report Period: The start date is the day after the last day covered by your last required report. The end date is the day you file the final report.

Unexpended Contributions Report-Annual Period: If this is the first Unexpended Contributions-Annual report you have filed, the start date is the day after the day you filed your Final Report. The start date for all other Unexpended Contributions-Annual reports is January 1 of the previous year. The end date for all Unexpended Contributions-Annual reports is December 31 of the previous year. Proper Ways to Dispose of Unexpended Funds and Assets

Unexpended Contributions Report-Final Period: If this is an Unexpended Contributions-Final report, the start date is the day after the period covered by your most recent Unexpended Contributions-Annual report. The end date is the date you file the Unexpended Contributions-Final report. Proper Ways to Dispose of Unexpended Funds and Assets

State Party Chair Candidates Only:

30th Day Before State Convention Report Period: The start date is the day after the last day covered by your last required report. If this is the first report you have filed, please see the First Reports section above. The end date is the 40th day before the date the state political party convention convenes.

8th Day Before State Convention Report Period: The start date is the 39th day before the convention. If this is the first report you have filed, please see the First Reports section above. The end date is the 10th day before the date the state political party convention convenes.

County Party Chair Candidates Only:

30th Day Before Primary Election Report Period: The start date is the day after the last day covered by your last required report. If this is the first report you have filed, please see the First Reports section above. The end date is the 40th day before the primary election. (This report is not required for unopposed candidates for County Party Chair or candidates for County Party Chair who are filing under the modified reporting schedule.)

8th Day Before Election Report Period: The start date is the 39th day before the primary election if you were required to file a 30th Day Before Primary Election Report. If you were not required to file the 30th Day Before Primary Election Report, the start date is the day after the last day covered by your last required report. If this is the first report you have filed, please see the First Reports section above. The end date is the 10th day before the primary election. (This report is not required for unopposed candidates for County Party Chair or candidates for County Party Chair who are filing under the modified reporting schedule.)

Runoff Report Period: The start date is the 9th day before the primary election if you filed an 8th Day Before Primary Election report in connection with the primary election. Otherwise, the start date is the day after the last day covered by your last required report or the day you appointed a campaign treasurer, whichever is later. The end date is the 10th day before the runoff election.

SC-COH: Cover Sheet – Candidate/Officeholder Information

Election Information:

State Party Chair Candidates - If you are a candidate in an upcoming state party chair election or were a candidate in a recently held state party chair election, provide the convening date of your political party's state convention.

County Party Chair Candidates - If you are a candidate in an upcoming primary election or were a candidate in a recently held primary election, provide the date of the election.

Convention/Election Date: Enter the month, day, and year of the primary election or party convention, as applicable.

Select Political Party: Select the name of the political party for which you are running from the drop-down menu. If your political party is not listed, select “Other” and enter your party name in the Description box.

Office Sought: Select the radio button for the party office you seek. If you are a candidate in an upcoming election, enter the office you seek. If you were a candidate in a recently held election, enter the office you recently sought.

County Name: (This field will be activated only if “County” is selected for the Office Sought”.) If you are a candidate for County Party Chair, select the name of the county from the drop-down menu.

SC-COH: Cover Sheet – Notices From PACs

Notice from Political Committee(s): Complete this section if you received notice from a political committee that it accepted political contributions or made political expenditures on your behalf. You are required to disclose the receipt of such a notice in the report covering the period in which you receive the notice. The committee is required to include the following information in the notice. If the notice also includes other information, such as a description of the contribution or expenditure, you are not required to include that information in this section.

SC-COH: Worksheet Summary

Worksheet Summary is a new page in the filing application designed to help you keep track of the schedules required for this report and the activity you enter. If you indicated by answering "Yes" on the previous Reporting Period Activities screen that you have activity to report, those schedules/categories are highlighted in green in the grid.

Worksheet Summary Grid: The reporting schedules/categories are organized into three main areas:

•

•

•

Under each main area, the information is displayed in the following columns:

Walk-Thru: Click this link to be guided through a series of questions to help you determine whether or not you may have activity to disclose on a particular report schedule. This option allows you to walk-through a single schedule only. During the walk-through, if you choose to "work on this later" the schedule will be flagged with a check mark in the

SC-COH: Schedule A1

NEW! Schedule A is now split into two schedules: Schedule A1 and Schedule A2. Enter only incoming monetary contributions on Schedule A1. (Non-monetary (in-kind) contributions are now entered on Schedule A2).

Schedule A1 is used to itemize incoming monetary political contributions that exceed $50 from one person during the reporting period. If you accepted other types of incoming funds or activity (such as pledges, non-monetary (in-kind) contributions, loans or interest), enter them on the applicable schedules associated with the categories shown on the Worksheet Summary page.

Contributions List: After you enter and save your first contribution, the filing application will begin a list of all contributions entered on Schedule A1 for this report. The list will display columns showing pertinent information for each contribution:

The contribution list will be the first screen you see each time you return to this schedule. From this list, you will be able to

Contributions from Out-of State Political Committees (These fields will be activated only if "Entity" is selected for the type of contributor.)

Is the Contributor an out of state PAC? Check this box only if the contributor is an out-of-state political committee (PAC). Certain restrictions apply to contributions from out-of-state PACs. The fact that a political committee has a mailing address outside of Texas does not mean that the committee is an out-of-state PAC for purposes of these restrictions. A political committee that has a campaign treasurer appointment on file in Texas is NOT an out-of-state PAC. A political committee that makes most of its political expenditures outside of Texas may be an out-of-state PAC. A political committee must determine if it is an out-of-state PAC.

PAC FEC #: If the out-of-state PAC is registered with the Federal Election Commission (FEC), enter the PAC’s FEC identification number (FEC #).

If you do not have an FEC # for the out-of-state PAC, you must provide other documentation as explained below.

Browse to Upload PDF. Attach a copy of one of the following required documents in PDF format to be included with your report:

If you accept

• a copy of the out-of-state PAC’s statement of organization filed as required by law with the Federal Election Commission (FEC) and certified by an officer of the out-of-state PAC; or

• a written statement, certified by an officer of the out-of-state PAC, listing the full name and address of each person who contributed more than $100 to the out-of-state PAC during the 12 months immediately preceding the contribution.

If you accept

• a copy of the out-of-state PAC’s statement of organization filed as required by law with the Federal Election Commission (FEC) and certified by an officer of the out-of-state PAC; or

• a document listing the committee’s name, address and phone number; the name of the person appointing the committee’s campaign treasurer; and the name, address and phone number of the committee’s campaign treasurer.

NOTE: If you accepted contributions from an out-of-state PAC and do not enter the FEC # or attach a PDF copy of the required information, you must timely file a paper copy of the required information at the time you file your electronic report.

Itemize box: Checking this box indicates that this contribution will be itemized on Schedule A1. The automatic default is to itemize. You are required to itemize contributions that exceed $50 (in the aggregate) from a single contributor. If you accepted two or more contributions from the same contributor, the total of which exceeded $50, enter each contribution separately and be sure the box is checked for each entry.

Contributor Address (Street Address, Country, City, State, Zip Code): Enter the complete address of the contributor.

Contributor Employer and Occupation Information (These fields will be activated only if "Individual" is selected for the type of contributor.)

SC-COH: Schedule E

Schedule E is used to itemize loans made for campaign purposes by financial institutions or individuals, and loans to your campaign from personal funds. You must itemize all loans that you accepted during the reporting period from financial institutions regardless of the amount. Additionally, you must itemize loans exceeding $50 from one person that you accepted during the reporting period.

Loans to Your Campaign from Your Personal Funds: If you make a political expenditure from personal funds and intend to seek reimbursement of any amount, the simplest way to disclose the expenditure is to use Schedule G (see the Schedule G Walk-Thru for more information). Another way is to disclose political expenditures from personal funds as a loan to your campaign on Schedule E. Outgoing political expenditures made from that loan must then be disclosed on Schedule F1. Remember: The amount you disclose as a loan from yourself in a reporting period may NOT exceed the amount you actually spent from personal funds in that reporting period. In other words, do not report a $100,000 loan to your campaign if the amount actually spent from your personal funds in the reporting period was $5,000. When you reimburse yourself, which could be months or years later, disclose the reimbursement as another outgoing political expenditure on Schedule F1. (Note: The reimbursement may not exceed the amount disclosed as a loan.)

Personal Funds Deposited into a Political Account: If you choose to deposit personal funds in an account in which political contributions are held as permitted by section 253.0351(c) of the Election Code, disclose the deposited amount as a loan on Schedule E and check the box indicating "Personal Funds Deposited into Political Account." (Note: Personal funds deposited in an account in which political contributions are held are subject to the personal use restriction.) Disclose the outgoing political expenditures made from that loan on Schedule F1. When you reimburse yourself, which could be months or years later, disclose the reimbursement as another outgoing political expenditure on Schedule F1. (Note: The reimbursement may not exceed the amount disclosed as a loan.)

Examples of Reporting Expenses From Personal Funds

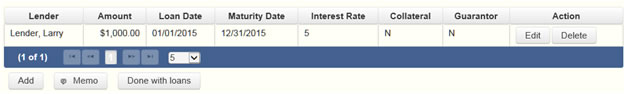

Loans List: After you enter and save your first loan, the filing application will begin a list of all loans entered on Schedule E for this report. The list will display columns showing pertinent information for each loan:

The loans list will be the first screen you see each time you return to this schedule. From this list, you will be able to

Itemize box: Checking this box indicates that this loan will be itemized on Schedule E. The automatic default is to itemize. You are required to itemize all loans from financial institutions, regardless of the amount. Additionally, you must itemize loans exceeding $50 from one person that you accepted during the reporting period. If you accepted two or more loans from the same person, the total of which exceeds $50, enter each loan separately.

Loans from Out-of State Political Committees (These fields will be activated only if "Entity" is selected for the type of lender.)

Is the Lender an out of state PAC? Check this box only if the lender is an out-of-state political committee (PAC). Certain restrictions apply to contributions (including loans) from out-of-state PACs. The fact that a political committee has a mailing address outside of Texas does not mean that the committee is an out-of-state PAC for purposes of these restrictions. A political committee that has a campaign treasurer appointment on file in Texas is NOT an out-of-state PAC. A political committee that makes most of its political expenditures outside of Texas may be an out-of-state PAC. A political committee must determine if it is an out-of-state PAC.

PAC FEC #: If the out-of-state PAC is registered with the Federal Election Commission (FEC), enter the PAC’s FEC identification number (FEC #).

If you do not have an FEC # for the out-of-state PAC, you must provide other documentation as explained below.

Browse to Upload PDF. Attach a copy of one of the following required documents in PDF format to be included with your report:

If you accept

• a copy of the out-of-state PAC’s statement of organization filed as required by law with the Federal Election Commission (FEC) and certified by an officer of the out-of-state PAC; or

• a written statement, certified by an officer of the out-of-state PAC, listing the full name and address of each person who contributed more than $100 to the out-of-state PAC during the 12 months immediately preceding the contribution.

If you accept

• a copy of the out-of-state PAC’s statement of organization filed as required by law with the Federal Election Commission (FEC) and certified by an officer of the out-of-state PAC; or

• a document listing the committee’s name, address and phone number; the name of the person appointing the committee’s campaign treasurer; and the name, address and phone number of the committee’s campaign treasurer.

NOTE: If you accepted loans from an out-of-state PAC and do not enter the FEC # or attach a PDF copy of the required information, you must timely file a paper copy of the required information at the time you file your electronic report.

NOTE: A person who guarantees all or part of a loan makes a reportable contribution in the amount of the guarantee. You must report such a contribution under “Enter Guarantor(s)” on Schedule E, and not on the contributions schedule.

Lender Employer and Occupation Information (These fields will be activated only if "Individual" is selected for the type of lender.)

Enter Guarantor(s) Instructions (These instructions will show if the filer selects "Page Help" on the entry screen)

NOTE: A person who guarantees all or part of a loan makes a reportable contribution in the amount of the guarantee. You must report such a contribution here under “Enter Guarantor(s)” on Schedule E, and not on the contributions schedule.

Guarantor Employer and Occupation Information (These fields will be activated only if "Individual" is selected for the type of guarantor.)

SC-COH: Schedule K

NEW! Investments purchased with political contributions, which were previously disclosed on Schedule K, are now disclosed on the new Schedule F3 (Purchase of Investments from Political Contributions).

Schedule K is used to itemize the following types of incoming funds that you received during the reporting period:

• Any credit, interest, rebate, refund, reimbursement, or return of a deposit fee resulting from the use of a political contribution or an asset purchased with a political contribution, the amount of which exceeds $100;

• Any proceeds of the sale of an asset purchased with a political contribution, the amount of which exceeds $100; and

• Any other gain from a political contribution, the amount of which exceeds $100.

Although you are not required to do so, you may also itemize on Schedule K any of these types of incoming funds that do not exceed $100. Unlike other schedules, you are NOT required to enter a lump sum total of unitemized Schedule K activity on the Schedule Subtotals page of this report.

Credits List: After you enter and save your first credit/gain/refund/returned contribution or interest, the filing application will begin a list of all credits/gains/refunds/returned contributions or interest entered on Schedule K for this report. The list will display columns showing pertinent information for each credit/gain/refund/returned contribution or interest:

The credits list will be the first screen you see each time you return to this schedule. From this list, you will be able to

SC-COH: Schedule F1

NEW! Schedule F is now split into two schedules: Schedule F1 and Schedule F2. Enter only outgoing political payments made from political contributions on Schedule F1. (Political expenditure obligations you incurred in this reporting period but have not yet paid are now entered on Schedule F2).

Schedule F1 is used to itemize outgoing campaign payments made from political contributions that exceed $100 to one individual or entity during the reporting period. If you had other types of outgoing funds or activity (such as investment purchases, political expenditures from personal funds, or unpaid incurred expenditure obligations), enter them on the applicable schedules associated with the categories shown on the Worksheet Summary page.

Important Restrictions Regarding The Use Of Political Funds To Rent Or Purchase Real Property

Reporting Tips to Avoid Common Pitfalls: Outgoing Expenditures

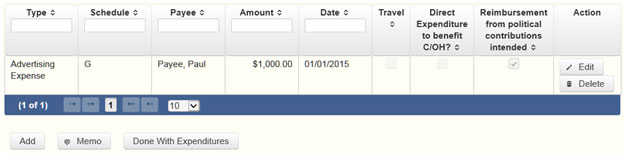

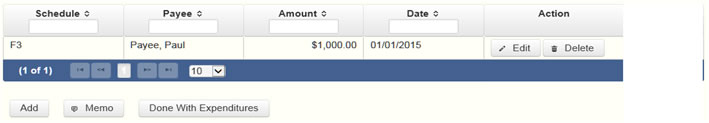

Political Expenditures List: After you enter and save your first political expenditure, the filing application will begin a list of all political expenditures entered on Schedule F1 for this report. The list will display columns showing pertinent information for each payee:

The political expenditures list will be the first screen you see each time you return to this schedule. From this list, you will be able to

Credit Card Expenditures: There is a special reporting rule for expenditures made by credit card. For reports due 30 days and 8 days before an election (pre-election reports) and for runoff reports, the date of a credit card expenditure is the date the credit card is used. For other reports, the date of a credit card expenditure is either the date of the charge or the date the credit card statement is received. A filer can never go wrong by disclosing the date of the expenditure as the date of the charge.

Itemize box: Checking this box indicates that this payment will be itemized on Schedule F1. The automatic default is to itemize. You are required to itemize payments that exceed $100 (in the aggregate) to a single payee. If you made two or more political payments to the same payee, the total of which exceeded $100, enter each payment separately and be sure the box is checked for each entry.

Expenditure Purpose. You must disclose the purpose of the expenditure in two parts: Category and Description. Merely disclosing the category of goods, services, or other thing of value for which the expenditure is made does not adequately describe the purpose of an expenditure.

Examples of Acceptable Ways to Report Expenditure Purpose

SC-COH: Schedule G

Schedule G is used to itemize outgoing campaign payments made from your personal funds during the reporting period. If you had other types of outgoing funds (such as investment purchases, political expenditures from political contributions, or unpaid incurred expenditure obligations), enter them on the applicable schedules associated with the categories shown on the Worksheet Summary page.

Reimbursement from Political Funds. If you intend to seek reimbursement in any amount from political contributions for a political expenditure made from personal funds, you must either itemize the expenditure here (Schedule G) and check the box to indicate that you intend to seek reimbursement or itemize the expenditure as a loan to yourself on Schedule E. The political expenditure from personal funds must be properly disclosed in the report covering the period in which the expenditure are made. You may not correct a report to allow reimbursement. If you deposit personal funds in an account in which political contributions are held as permitted by section 253.0351(c) of the Election Code, you must report the deposited amount as a loan on Schedule E. See the Schedule E "Page Help" for additional information.

Important Restrictions Regarding The Use Of Political Funds To Rent Or Purchase Real Property

Reporting Tips to Avoid Common Pitfalls: Outgoing Expenditures

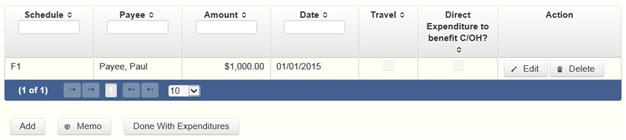

Political Expenditures from Personal Funds List: After you enter and save your first political expenditure from personal funds, the filing application will begin a list of all political expenditures from personal funds entered on Schedule G for this report. The list will display columns showing pertinent information for each payee:

The political expenditures from personal funds list will be the first screen you see each time you return to this schedule. From this list, you will be able to

Reimbursement from Political Contributions Intended box: Check this box if you intend to reimburse yourself for this payment made out of your personal funds. (In order to be reimbursed from political contributions in any amount, you must itemize the political payment on this schedule and check this box or you must itemize the expenditure as a loan to yourself on Schedule E.)

Itemize box: Checking this box indicates that this payment will be itemized on Schedule G. The automatic default is to itemize. Even if you do not intend to seek reimbursement, you are required to itemize political payments made from personal funds that exceed $100 (in the aggregate) to a single payee. If you made two or more political payments to the same payee, the total of which exceeded $100, enter each payment separately and be sure the "itemize" box is checked for each entry.

Expenditure Purpose. You must disclose the purpose of the expenditure in two parts: Category and Description. Merely disclosing the category of goods, services, or other thing of value for which the expenditure is made does not adequately describe the purpose of an expenditure.

Examples of Acceptable Ways to Report Expenditure Purpose

SC-COH: Schedule H

Schedule H is used to itemize outgoing campaign payments to a business in which you have one or more of the following interests or positions:

1) a participating interest of more than 10%;

2) a position on the governing body of the business;

3) a position as an officer of the business.

Itemize such payments on this Schedule H and not on Schedule F1 (used for monetary political expenditure payments). If you had other types of outgoing funds or activity (such as investment purchases, other political expenditures, or unpaid incurred expenditure obligations), enter them on the applicable schedules associated with the categories shown on the Worksheet Summary page.

Important Restrictions Regarding Payments To A Business Of The Candidate

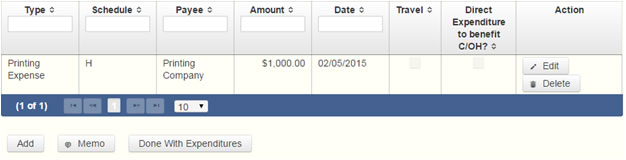

Payment from Political Contributions to Business of C/OH List: After you enter and save your first payment, the filing application will begin a list of all payments entered on Schedule H for this report. The list will display columns showing pertinent information for each payee:

The payments from political contributions to a business of C/OH list will be the first screen you see each time you return to this schedule. From this list, you will be able to

Itemize box: The automatic default is to itemize. You are required to itemize payments from political contributions that were made to a business in which you have an interest of more than 10%, a position on the governing body, or a position as an officer, regardless of the amount. If you made two or more such political payments to the same payee, enter each payment separately.

Expenditure Purpose. You must disclose the purpose of the expenditure in two parts: Category and Description. Merely disclosing the category of goods, services, or other thing of value for which the expenditure is made does not adequately describe the purpose of an expenditure.

Examples of Acceptable Ways to Report Expenditure Purpose

SC-COH: Schedule I

Schedule I is used to itemize non-political payments made from political funds, regardless of the amount. If you had other types of outgoing funds or activity (such as political expenditures from political or personal funds, or unpaid incurred expenditure obligations), enter them on the applicable schedules associated with the categories shown on the Worksheet Summary page.

A non-political expenditure is an expenditure that is neither a campaign expenditure nor an officeholder expenditure. As a practical matter, very few expenditures made from political contributions are non-political expenditures. For instance, expenditures for administrative expenses, banking fees, and professional dues are typically political expenditures and should not be disclosed on Schedule I. Remember that you may not convert political contributions to personal use.

Payments to a Business of Candidate: Do not report on this schedule non-political expenditures from political contributions made to a business in which you have a participating interest of more than 10%, a position on the governing body, or a position as an officer. Report those types of expenditures on Schedule H. See Schedule H for more information about these types of expenditures.

Non-Political Expenditures List: After you enter and save your first non-political expenditure, the filing application will begin a list of all non-political expenditures entered on Schedule I for this report. The list will display columns showing pertinent information for each payee:

The non-political expenditures list will be the first screen you see each time you return to this schedule. From this list, you will be able to

Credit Card Expenditures: There is a special reporting rule for expenditures made by credit card. For reports due 30 days and 8 days before an election (pre-election reports) and for runoff reports, the date of a credit card expenditure is the date the credit card is used. For other reports, the date of a credit card expenditure is either the date of the charge or the date the credit card statement is received. A filer can never go wrong by disclosing the date of the expenditure as the date of the charge.

Itemize box: The automatic default is to itemize. You are required to itemize non-political payments from political contributions, regardless of the amount. If you made two or more such political payments to the same payee, enter each payment separately.

Expenditure Purpose. You must disclose the purpose of the expenditure in two parts: Category and Description. Merely disclosing the category of goods, services, or other thing of value for which the expenditure is made does not adequately describe the purpose of an expenditure.

Examples of Acceptable Ways to Report Expenditure Purpose

SC-COH: Schedule F3

NEW! Schedule F3 is a new schedule used to disclose information about investments of over $100 purchased with political contributions. Prior to January 1, 2015, this activity was disclosed on Schedule K (used for other incoming funds earned or returned to your political account).

Schedule F3 is used to itemize any investment purchased in the reporting period with political funds, the amount of which exceeds $100. If you had other types of outgoing funds or activity (such as political expenditures from political or personal funds, or unpaid incurred expenditure obligations), enter them on the applicable schedules associated with the categories shown on the Worksheet Summary page.

Purchased Investments List: After you enter and save your first investment purchased with political contributions, the filing application will begin a list of all purchased investments entered on Schedule F3 for this report. The list will display columns showing pertinent information for each payee:

The purchased investments list will be the first screen you see each time you return to this schedule. From this list, you will be able to

Itemize box: The automatic default is to itemize. You are required to itemize investments that exceed $100. If you made two or more payments to the same payee to purchase an investment, the total of which exceeded $100, enter each payment separately.

SC-COH: Schedule A2

NEW! Schedule A is now split into two schedules: Schedule A1 and Schedule A2. Enter only incoming non-monetary (in-kind) contributions of goods, services, or other thing of value on Schedule A2. (Monetary contributions are now entered on Schedule A1).

Schedule A2 is used to itemize incoming non-monetary (in-kind) political contributions of goods, services, or other thing of value that exceed $50 from one person during the reporting period. If you accepted other types of incoming funds or activity (such as monetary contributions, pledges, loans, or interest), enter them on the applicable schedules associated with the categories shown on the Worksheet Summary page.

Contribution of Personal Services or Travel: You are not required to include contributions of an individual’s personal services or travel if the individual receives no compensation from any source for the services.

Non-Monetary Contributions List: After you enter and save your first non-monetary (in-kind) contribution, the filing application will begin a list of all contributions entered on Schedule A2 for this report. The list will display pertinent information for each contribution:

The non-monetary contributions list will be the first screen you see each time you return to this schedule. From this list, you will be able to

Contributions from Out-of State Political Committees (These fields will be activated only if "Entity" is selected for the type of contributor.)

Is the Contributor an out of state PAC? Check this box only if the contributor is an out-of-state political committee (PAC). Certain restrictions apply to contributions from out-of-state PACs. The fact that a political committee has a mailing address outside of Texas does not mean that the committee is an out-of-state PAC for purposes of these restrictions. A political committee that has a campaign treasurer appointment on file in Texas is NOT an out-of-state PAC. A political committee that makes most of its political expenditures outside of Texas may be an out-of-state PAC. A political committee must determine if it is an out-of-state PAC.

PAC FEC #: If the out-of-state PAC is registered with the Federal Election Commission (FEC), enter the PAC’s FEC identification number (FEC #).

If you do not have an FEC # for the out-of-state PAC, you must provide other documentation as explained below.

Browse to Upload PDF. Attach a copy of one of the following required documents in PDF format to be included with your report:

If you accept

• a copy of the out-of-state PAC’s statement of organization filed as required by law with the Federal Election Commission (FEC) and certified by an officer of the out-of-state PAC; or

• a written statement, certified by an officer of the out-of-state PAC, listing the full name and address of each person who contributed more than $100 to the out-of-state PAC during the 12 months immediately preceding the contribution.

If you accept

• a copy of the out-of-state PAC’s statement of organization filed as required by law with the Federal Election Commission (FEC) and certified by an officer of the out-of-state PAC; or

• a document listing the committee’s name, address and phone number; the name of the person appointing the committee’s campaign treasurer; and the name, address and phone number of the committee’s campaign treasurer.

NOTE: If you accepted contributions from an out-of-state PAC and do not enter the FEC # or attach a PDF copy of the required information, you must timely file a paper copy of the required information at the time you file your electronic report.

Itemize box: Checking this box indicates that this in-kind contribution will be itemized on Schedule A2. The automatic default is to itemize. You are required to itemize contributions that exceed $50 (in the aggregate) from a single contributor. If you accepted two or more contributions from the same contributor, the total of which exceeded $50, enter each contribution separately and be sure the box is checked for each entry.

Contributor Employer and Occupation Information (These fields will be activated only if "Individual" is selected for the type of contributor.)

SC-COH: Schedule B

NEW! As always, you must disclose a pledge on Schedule B in the reporting period in which you accepted the pledge. Effective January 1, 2015, you must also disclose the receipt of the pledged contribution on Schedule A1 (used for monetary contributions) or A2 (used for non-monetary contributions), as applicable, in the reporting period in which you actually receive the pledged money or thing of value. If the pledge is accepted and received in the same reporting period, it is no longer a pledge disclosed here; it becomes a contribution disclosed on the applicable contributions schedule.

Schedule B is used to itemize pledges (monetary or in-kind) that exceed $50 from one person during the reporting period. If you accepted monetary incoming funds (such as contributions, loans, or interest) or received non-monetary (in-kind) contributions, enter them on the applicable schedules associated with the categories shown on the Worksheet Summary page.

Pledge of Personal Services or Travel: You are not required to include pledges of an individual’s personal services or travel if the individual receives no compensation from any source for the services.

Pledged Contributions List: After you enter your first pledged contribution, the filing application will begin a list of all contributions entered on Schedule B for this report. The list will display pertinent information for each contribution:

The pledged contributions list will be the first screen you see each time you return to this schedule. From this list, you will be able to

Contributions from Out-of State Political Committees (These fields will be activated only if "Entity" is selected for the type of contributor.)

Is the Contributor an out of state PAC? Check this box only if the contributor is an out-of-state political committee (PAC). Certain restrictions apply to contributions from out-of-state PACs. The fact that a political committee has a mailing address outside of Texas does not mean that the committee is an out-of-state PAC for purposes of these restrictions. A political committee that has a campaign treasurer appointment on file in Texas is NOT an out-of-state PAC. A political committee that makes most of its political expenditures outside of Texas may be an out-of-state PAC. A political committee must determine if it is an out-of-state PAC.

PAC FEC #: If the out-of-state PAC is registered with the Federal Election Commission (FEC), enter the PAC’s FEC identification number (FEC #).

If you do not have an FEC # for the out-of-state PAC, you must provide other documentation as explained below.

Browse to Upload PDF. Attach a copy of one of the following required documents in PDF format to be included with your report:

If you accept

• a copy of the out-of-state PAC’s statement of organization filed as required by law with the Federal Election Commission (FEC) and certified by an officer of the out-of-state PAC; or

• a written statement, certified by an officer of the out-of-state PAC, listing the full name and address of each person who contributed more than $100 to the out-of-state PAC during the 12 months immediately preceding the contribution.

If you accept

• a copy of the out-of-state PAC’s statement of organization filed as required by law with the Federal Election Commission (FEC) and certified by an officer of the out-of-state PAC; or

• a document listing the committee’s name, address and phone number; the name of the person appointing the committee’s campaign treasurer; and the name, address and phone number of the committee’s campaign treasurer.

NOTE: If you accepted contributions from an out-of-state PAC and do not enter the FEC # or attach a PDF copy of the required information, you must timely file a paper copy of the required information at the time you file your electronic report.

Itemize box: Checking this box indicates that this pledge will be itemized on Schedule B. The automatic default is to itemize. You are required to itemize pledges that exceed $50 (in the aggregate) from a single contributor. If you accepted two or more pledges from the same contributor, the total of which exceeded $50, enter each pledge separately and be sure the box is checked for each entry.

Contributor Employer and Occupation Information (These fields will be activated only if "Individual" is selected for the type of contributor.)

SC-COH: Schedule F2

NEW! Schedule F is now split into two schedules: Schedule F1 and Schedule F2. Enter only expenditure obligations that you have incurred but not yet paid on Schedule F2. (Political expenditures that were paid in this reporting period are disclosed on Schedule F1 (used for political payments from political funds) or Schedule G (used for political payments from personal funds), as applicable.) Non-political expenditures that were paid in this reporting period are disclosed on Schedule I.) Effective January 1, 2015, you must also disclose when you actually pay the incurred expenditure. You must disclose the outgoing payment on Schedule F1, G, or I, as applicable, in the reporting period in which you pay the expenditure.

Schedule F2 is used to itemize political expenditures you have incurred but not yet paid that exceed $100 to one individual or entity during the reporting period. Also use this schedule to itemize any non-political expenditures you have incurred but not yet paid during the reporting period, regardless of the amount. If you had outgoing funds (such as investment purchases or political payments from political or personal funds), enter them on the applicable schedules associated with the categories shown on the Worksheet Summary page.

Important Restrictions Regarding The Use Of Political Funds To Rent Or Purchase Real Property

Reporting Tips to Avoid Common Pitfalls: Outgoing Expenditures

Unpaid Incurred Obligations List: After you enter and save your first unpaid incurred obligation, the filing application will begin a list of all unpaid incurred obligations entered on Schedule F2 for this report. The list will display columns showing pertinent information for each payee:

The unpaid incurred obligations list will be the first screen you see each time you return to this schedule. From this list, you will be able to

Tell Me More About Incurred Expenditure Obligations

Itemize box: Checking this box indicates that this incurred expenditure will be itemized on Schedule F2. The automatic default is to itemize. You are required to itemize political expenditures that exceed $100 (in the aggregate) to a single payee. You are required to itemize any non-political expenditure, regardless of the amount. If you incurred two or more incurred expenditures to the same payee, the total of which exceeded $100, enter each incurred expenditure obligation separately and be sure the box is checked for each entry.

Expenditure Purpose. You must disclose the purpose of the expenditure in two parts: Category and Description. Merely disclosing the category of goods, services, or other thing of value for which the expenditure is made does not adequately describe the purpose of an expenditure.

Examples of Acceptable Ways to Report Expenditure Purpose

SC-COH: Out-of-State Travel Information

Non-monetary (In-kind) Contribution or Political Expenditure for Travel Outside of Texas: In addition to the required information you enter on the applicable political contribution or expenditure schedule, the description of an in-kind contribution, in-kind pledge, or political expenditure for travel outside of the state of Texas must include other detailed information. The required additional detailed information you enter on this screen will be included in your report on Schedule T.

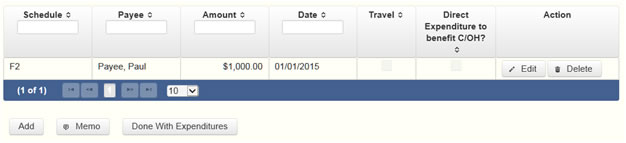

SC-COH: Direct Expenditures – Candidate Information

If you made a direct campaign expenditure payment to benefit another candidate or officeholder, you must include additional information about the candidate/officeholder. Do not complete this section if the expenditure was not a direct campaign expenditure.

SC-COH: Schedule Subtotals

Schedule Subtotals is a new page of the reporting form intended to supplement the report totals (cover sheet, page 2). This page displays the calculated Subtotal for each report schedule, based on the amounts you entered on the schedule entry screen (reported itemized and reported unitemized) and any other unitemized total you enter as a lump sum amount here (user entered lump sum unitemized).

You are always required to itemize or report detailed information for contributions, expenditures, and loans over a certain monetary threshold. The thresholds vary depending on the type of activity (see "Itemization Thresholds" below). For smaller contributions, expenditures, and loans that do not exceed the threshold (in the aggregate for a single source), you may report them in one of two ways: 1) add them all together and enter the unitemized total as a lump sum; OR 2) enter the detailed information on the schedule entry screen (and choose to itemize or not).

Itemized transactions: The filing application calculates the sum of the entries for each schedule and the amount is displayed in the Reported Itemized column for the applicable schedule.

Unitemized transactions: Depending on your choice of entry, your unitemized transactions are shown under one of the following columns:

Itemization Thresholds for Each Schedule: To return to the instructions for each schedule, click on the applicable link.

Monetary Political Contributions (A1) – You are not required to itemize contributions (in the aggregate from a single source) of $50 or less. If not entered on this schedule, you must enter a lump sum.

Loans (E) - You are not required to itemize loans (in the aggregate from a single source) of $50 or less. If not entered on this schedule, you must enter a lump sum.

Interest, Credits, Gains, Refunds, and Contributions Returned to Filer (K) – You are not required to itemize such activity (in the aggregate from a single source) of $100 or less. You are not required to enter a lump sum for this schedule.

Political Expenditures from Political Contributions (F1) – You are not required to itemize political expenditures (in the aggregate to a single payee) of $100 or less. If not entered on this schedule, you must enter a lump sum.

Political Expenditures from Personal Funds (G) - You are not required to itemize political expenditures (in the aggregate to a single payee) of $100 or less. If not entered on this schedule, you must enter a lump sum. (Note: You are required to itemize political expenditures from personal funds in any amount, if you intend to seek reimbursement from political contributions.)

Payment from Political Contributions to the Business of a C/OH (H) – There is no itemization threshold for this schedule. You must itemize all such payments.

Non-political Expenditures from Political Contributions (I) – There is no itemization threshold for this schedule. You must itemize all non-political expenditures from political contributions.

Purchase of Investments from Political Contributions (F3) – You are not required to itemize investments (in the aggregate from a single source) of $100 or less. You are not required to enter a lump sum for this schedule.

Non-monetary (In-kind) Political Contributions (A2) – You are not required to itemize contributions (in the aggregate from a single source) of $50 or less. If not entered on this schedule, you must enter a lump sum.

Pledged Contributions (B) - You are not required to itemize pledges (in the aggregate from a single source) of $50 or less. If not entered on this schedule, you must enter a lump sum.

Unpaid Incurred Obligations (F2) – You are not required to itemize incurred but not yet paid political expenditures (in the aggregate to a single payee) of $100 or less. If not entered on this schedule, you must enter a lump sum. You are required to itemize all incurred but not yet paid non-political expenditures, regardless of the amount.

SC-COH: Report Totals (Cover Sheet, Page 2)

You are required to include in your campaign finance report the following total amounts of contributions, expenditures, and loans:

The law requires you to disclose the total amount of political contributions accepted, including interest or other income on those contributions, maintained in one or more accounts in which political contributions are deposited as of the last day of the reporting period.

The "total amount of political contributions maintained" includes: the total amount of political contributions maintained in one or more accounts, including the balance on deposit in banks, savings and loan institutions and other depository institutions and the present value of any investments that can be readily converted to cash, such as certificates of deposit, money market accounts, stocks, bonds, treasury bills, etc.

SC-COH: Report Error Check

Report Error Check is a tool to assist you in fulfilling your reporting requirements. The Error Check details errors and omissions in the data entry; it does not verify that the report has satisfied all legal requirements. You should review the applicable TEC Guide and the filing application PAGE HELP to ensure that ALL required information is included before you file your report.

If the Error Check finds errors in your report, the errors will be listed for you in a table on this screen. You can also click the

The errors list includes the following information:

SC-COH: Correction Affidavit

A filer who files a corrected report must submit a Correction Affidavit. The affidavit must identify the information that has changed. The affidavit also provides check boxes for your use in swearing to certain statutory provisions regarding the corrected report, if applicable.

A corrected report (other than an 8th Day Before Election Report or a Daily Pre-election Report) filed with the TEC after its due date is not considered late for purposes of late-filing penalties if the report meets this "14th business day in good faith" statutory provision.

A correction to an 8th Day Before Election Report must also meet the "14th business day in good faith" statutory provision, however, the corrected report could be subject to a late-filing penalty unless the report as originally filed substantially complies with the applicable law as determined by the Ethics Commission. The person responsible for filing the report may request a waiver or reduction of any late-filing penalty assessed.

Each table includes columns with the following information:

SC-COH: Final Report Affidavit

You may file a Final report if you have a campaign treasurer appointment (Form CTA) on file with the TEC and meet all of the following: 1) do not expect to accept any more campaign contributions or make or authorize any more campaign expenditures, 2) expect to take no further action to get elected to a public office, and 3) do not intend to continue accepting contributions to pay campaign debts. There is not a fixed deadline for this report.

• You must have a CTA on file to accept contributions to offset campaign debts or to pay campaign debts. If you intend to continue this campaign activity, do not file a Final report at this time.

• A Final report will terminate your CTA and relieve you from any additional filing obligations as a candidate. If you have surplus political funds or assets, you will be required to file annual Unexpended Contribution reports. (See Final Disposition of Unexpended Contributions for more information.)

• Terminating a CTA does not relieve you of your responsibility for any delinquent reports or outstanding civil penalties.

• An elected State Party Chair who does not have a CTA on file is still required to file a personal financial statement (PFS) in accordance with chapter 572 of the Government Code. You can set up a PFS filer type with TEC to file PFS using this filing application, if applicable.

Final Report Affidavit: This page includes the Final report affidavit language. You must agree to and acknowledge the affidavit to indicate that you understand the consequences of filing a Final report. To do so, select the radio button next to the statement, “I agree to and acknowledge the above affidavit.”

If you intend to have additional campaign activity and are not ready to file a Final report, select the radio button next to the statement, “I do not agree to the above affidavit.” You will have some options as to how you wish to continue:

SC-COH: Final Report Campaign Funds & Assets

Unexpended Contributions & Retained Assets

Select the applicable radio buttons to indicate that you either do or do not retain unexpended contributions, unexpended interest or income earned from political contributions, or assets purchased with political contributions or interest or other income from political contributions.

You will no longer be required to file reports unless you retain political contributions, interest or other income from political contributions, or assets purchased with political contributions or interest or other income from political contributions. If you retain any of those items, you must file an Annual Report of Unexpended Contributions not earlier than January 1 and not later than January 15 of each year after the year in which you filed your final report. You may not retain these unexpended funds longer than six years after the date of filing a final report. Remember: You may not convert unexpended political contributions, unexpended interest or income earned on political contributions, or assets purchased with political contributions or interest or other income from political contributions to personal use. Proper Ways to Dispose of Unexpended Funds and Assets

SC-COH: Appendix

Examples of Reporting Expenses From Personal Funds

Spending your own money on your campaign? Avoid common reporting errors! If you intend to seek reimbursement of any amount from political contributions for a political expenditure made from your personal funds, report the expenditure in one of three ways. Method 3 is a new method that will become available on September 28, 2011. We think that Method #1 is the simplest method. Keep in mind that this reporting system is not an accounting system and duplication of expenditures is not uncommon when reporting transactions related to expenditures made from personal funds.

Method #1: Itemize the expenditure on the “Political Expenditures From Personal Funds” schedule (Schedule G) and check the box to indicate that you intend to seek reimbursement from political contributions. (You may not correct a report to allow reimbursement without subjecting yourself to a possible penalty.) When you reimburse yourself, which could be months or years later, report the reimbursement on the “Political Expenditures” schedule (Schedule F1).

We stress that if you intend to seek reimbursement from political contributions for a political expenditure of any amount made from personal funds, you must itemize the expenditure on Schedule G. .

Method #2: Report the political expenditures made from your personal funds as a loan to your campaign on the “Loans” schedule (Schedule E). Next, report the political expenditures made from that loan on the “Political Expenditures” schedule (Schedule F1). Remember, the amount you report as a loan in a reporting period may NOT exceed the amount you actually spent from personal funds in that reporting period. In other words, do not report a $100,000 loan to your campaign if the amount actually spent from personal funds in the reporting period was $5,000. When you reimburse yourself, which could be months or years later, report the reimbursement on the Schedule F1.

Method #3: Deposit personal funds in an account in which your political contributions are maintained and report that amount as a loan on the "Loans" schedule (Schedule E). Next, report the political expenditures made from that loan on the "Political Expenditures" schedule (Schedule F1). When you reimburse yourself, which could be months or years later, report the reimbursement on the Schedule F1. (Note that the reimbursement may not exceed the amount reported as a loan. Also note that personal funds deposited in an account in which political contributions are held are subject to the personal use restriction.)

Use of Political Funds to Rent or Purchase Real Property

A candidate or officeholder is prohibited from using political funds to purchase real property or to pay the interest on or principal of a note for the purchase of real property.

A candidate or officeholder may not knowingly make or authorize a payment from political funds for the rental or purchase of real property from: (1) a person related to the candidate or officeholder within the second degree of consanguinity or affinity as determined under Chapter 573, Government Code; or (2) a business in which the candidate or officeholder (or a person related to the candidate or officeholder within the second degree of consanguinity or affinity) has a participating interest of more than 10 percent, holds a position on the governing body, or serves as an officer. Elec. Code § 253.038 (a-1). This restriction applies to a payment made from political funds on or after September 1, 2007, without regard to whether the payment was made under a lease or other agreement entered into before that date.

Reporting Tips to Avoid Common Pitfalls: Outgoing Expenditures

Always disclose the name of the vendor who sold the goods or services, as the payee for expenditures by credit card, NOT the credit card issuer. DO NOT disclose as the payee the name of the credit card issuer. (If the credit card issuer assesses you a finance charge or late fee in connection with a political expenditure, then it would be accurate to disclose the credit card issuer as the payee for that payment.)

You can never go wrong by disclosing the date the credit card was charged as the expenditure date. For 30-day and 8-day pre-election reports, the expenditure date is the date of the credit card charge, not the date of the credit card bill. For all other reports, the expenditure date may be either the date of the charge or the date of receipt of the credit card bill that includes the expenditure.

If you make an expenditure for goods or services to benefit another candidate, officeholder, or committee, disclose the vendor who sold you the goods or services as the payee. DO NOT disclose as the payee the name of the candidate, officeholder, or committee that benefitted from the expenditure. Include that person's name under the purpose description.

Did a staff worker make political payment(s) out of his or her personal funds? How you disclose the payment(s) depends on two things: 1) the aggregate total of those payments in the reporting period; and 2) whether or not you reimburse the staff worker in the same reporting period.

Examples Of Expenditures

This list is for illustrative purposes only. It is intended to provide helpful information and to assist filers in reporting the purpose of an expenditure. However, it is not, and is not intended to be, an exhaustive or an exclusive list of how a filer may permissibly report the purpose of an expenditure.

(1) Example: Candidate X is seeking the office of State Representative, District 2000. She purchases an airline ticket from ABC Airlines to attend a campaign rally within District 2000. The acceptable category for this expenditure is “travel in district.” The candidate activity that is accomplished by making the expenditure is to attend a campaign rally. An acceptable brief statement is “airline ticket to attend campaign event.”

(2) Example: Candidate X purchases an airline ticket to attend a campaign event outside of District 2000 but within Texas, the acceptable category is “travel out of district.” The candidate activity that is accomplished by making the expenditure is to attend a campaign event. An acceptable brief statement is “airline ticket to attend campaign or officeholder event.”

(3) Example: Candidate X purchases an airline ticket to attend an officeholder related seminar outside of Texas. The acceptable method for the purpose of this expenditure is by selecting the “travel out of district” category and completing the “Schedule T” (used to report travel outside of Texas).

(4) Example: Candidate X contracts with an individual to do various campaign related tasks such as work on a campaign phone bank, sign distribution, and staffing the office. The acceptable category is “salaries/wages/contract labor.” The candidate activity that is accomplished by making the expenditure is to compensate an individual working on the campaign. An acceptable brief statement is “contract labor for campaign services.”

(5) Example: Officeholder X is seeking re-election and makes an expenditure to purchase a vehicle to use for campaign purposes and permissible officeholder purposes. The acceptable category is “transportation equipment and related expenses” and an acceptable brief description is “purchase of campaign/officeholder vehicle.”

(6) Example: Candidate X makes an expenditure to repair a flat tire on a campaign vehicle purchased with political funds. The acceptable category is “transportation equipment and related expenses” and an acceptable brief description is “campaign vehicle repairs.”

(7) Example: Officeholder X purchases flowers for a constituent. The acceptable category is “gifts/awards/memorials expense” and an acceptable brief description is “flowers for constituent.”

(8) Example: Political Committee XYZ makes a political contribution to Candidate X. The acceptable category is “contributions/donations made by candidate/officeholder/political committee” and an acceptable brief description is “campaign contribution.”

(9) Example: Candidate X makes an expenditure for a filing fee to get his name on the ballot. The acceptable category is “fees” and an acceptable brief description is “candidate filing fee.”

(10) Example: Officeholder X makes an expenditure to attend a seminar related to performing a duty or engaging in an activity in connection with the office. The acceptable category is “fees” and an acceptable brief description is “attend officeholder seminar.”

(11) Example: Candidate X makes an expenditure for political advertising to be broadcast by radio. The acceptable category is “advertising expense” and an acceptable brief description is “political advertising.” Similarly, Candidate X makes an expenditure for political advertising to appear in a newspaper. The acceptable category is “advertising expense” and an acceptable brief description is “political advertising.”

(12) Example: Officeholder X makes expenditures for printing and postage to mail a letter to all of her constituents, thanking them for their participation during the legislative session. Acceptable categories are “advertising expense” OR “printing expense” and an acceptable brief description is “letter to constituents.”

(13) Example: Officeholder X makes an expenditure to pay the campaign office electric bill. The acceptable category is “office overhead/rental expense” and an acceptable brief description is “campaign office electric bill.”

(14) Example: Officeholder X makes an expenditure to purchase paper, postage, and other supplies for the campaign office. The acceptable category is “office overhead/rental expense” and an acceptable brief description is “campaign office supplies.”

(15) Example: Officeholder X makes an expenditure to pay the campaign office monthly rent. The acceptable category is “office overhead/rental expense” and an acceptable brief description is “campaign office rent.”

(16) Example: Candidate X hires a consultant for fundraising services. The acceptable category is “consulting expense” and an acceptable brief description is “campaign services.”

(17) Example: Candidate/Officeholder X pays his attorney for legal fees related to either campaign matters or officeholder matters. The acceptable category is “legal services” and an acceptable brief description is “legal fees for campaign” or “for officeholder matters.”

(18) Example: Candidate/Officeholder X makes food and beverage expenditures for a meeting with her constituents. The acceptable category is “food/beverage expense” and an acceptable brief statement is “meeting with constituents.”

(19) Example: Candidate X makes food and beverage expenditures for a meeting to discuss candidate issues. The acceptable category is “food/beverage expense” and an acceptable brief statement is “meeting to discuss campaign issues.”

(20) Example: Officeholder X makes food and beverage expenditures for a meeting to discuss officeholder issues. The acceptable category is “food/beverage expense” and an acceptable brief statement is “meeting to discuss officeholder issues.”